We here at Calcbench know that a significant portion of our customer base uses our data for financial analysis. To that end, today’s post is about how to create a peer group within our databases, so you can benchmark your data more quickly and easily.

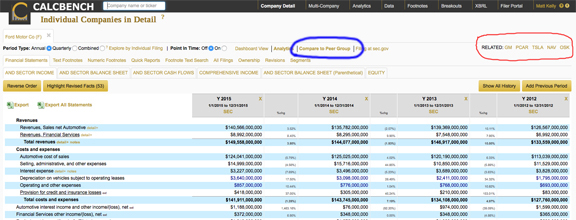

First, in many instances Calcbench will throw a few suggestions your way. For example, we visited the Company-in-Detail page, and pulled up the most recent annual statements for Ford Motor Co. Those results are below, and notice in the upper-right corner we have a “Related” line (circled in red) with a few Ford peers: GM, Tesla, and Oshkosh, among others. Click on any of those ticker symbols, and we automatically pull up the same financial data for that company in a separate page.

We also provide a larger peer group in another feature called—wait for it—“Compare to Peer Group.” That item is circled in blue, above. It will open a new page with a more expansive list of peer companies, and compare a few basic line items (revenue, operating income, assets, etc.) for all of them. You can then add your own columns and do further research from there.

We have a few other ways to create your own peer group, too. Let’s review.

Choose Your Companies

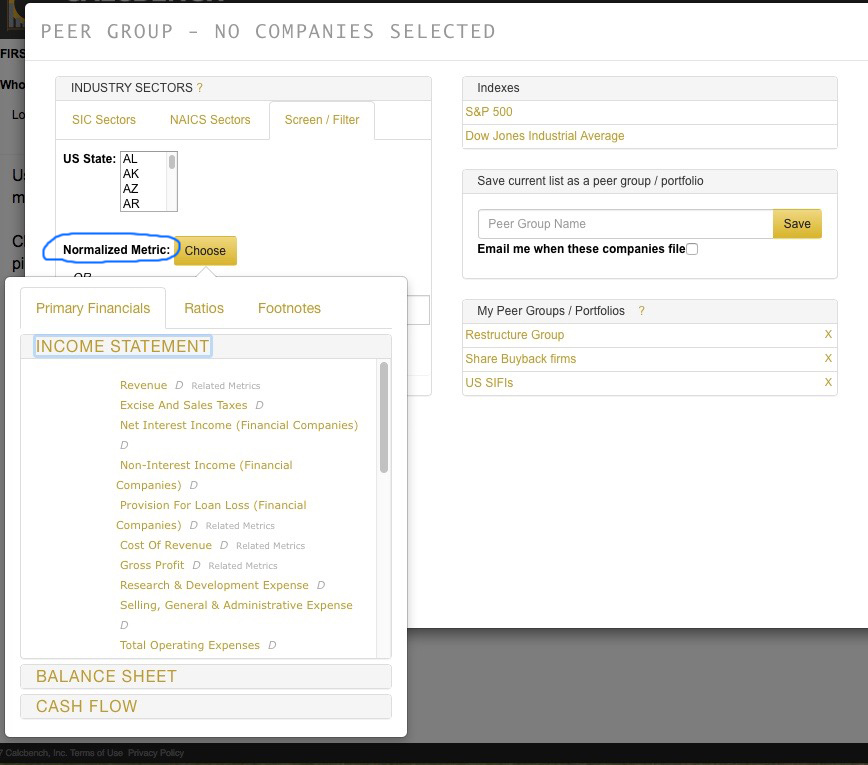

The most versatile way to build your own peer group is our Choose Companies button. On almost every page of our site, that button is somewhere in the upper left corner. Press it, and you see this image, below.

Here, you can select industry groups by SIC or NAICS sector. The coding systems are similar but not always identical; so you will get mostly the same companies within a sector regardless of which system you choose—but we can’t guarantee that SIC and NAICS groupings will always be identical. Plan accordingly.

You can also set up a screen, if you want to compile a list of peers by geography, revenue, or some other financial metric. First, select the Screen/Filter feature. Then you can sort by U.S. state; or by one of many financial metrics.

To search by metric, look for the Choose button next to “Normalized Metric.” (See Figure 3, below; circled in blue.) You can then sift through any number of metrics on the financial statements, including footnotes or even financial ratio (which Calcbench can calculate for you). Once you choose your metric, you can also set filters using the last pull-down menu on this screen: greater than, less than, or not equal to whatever number you want.

How can you apply multiple metrics? That’s easy to do, but you must do it one at a time. For example, you might search all clothing companies in the retail sector by SIC code; then filter by a state; then filter by revenue over $50 million; then filter by profit margin. Every time, be sure the “Filter existing list” button is marked, to keep refining the list.

Adding Companies

And if you have your own list of companies ready to go? That’s easy, too. Just open the Choose Companies screen, and on the far left, hit “Enter Ticker List.” (See Figure 4, below; circled in blue.) A new tab opens where you can add your companies in a simple cut-and-paste job.

Or if you use our features to refine your peer group somewhat, but you still want to add a few more companies of your own, just add those ticker symbols in the Add Company text box.

When you’re done, you can save your peer group for future reference by using the box in the middle. Just give the group a name and press the Save button (circled in red, Figure 4 above). The group will remain there and be available every time you open the Choose Companies box until you delete it.

0 Comments