Sometimes the sign of the number reported in XBRL and retrieved from Calcbench using raw XBRL tag will be different than the sign in the source document (the company's filing). This is a result of XBRL calculations included in the company's filings. Specifically, the difference in signs would happen when the change in the balance of the account is the opposite of the numbers role in the calculation in the table in the source statement.

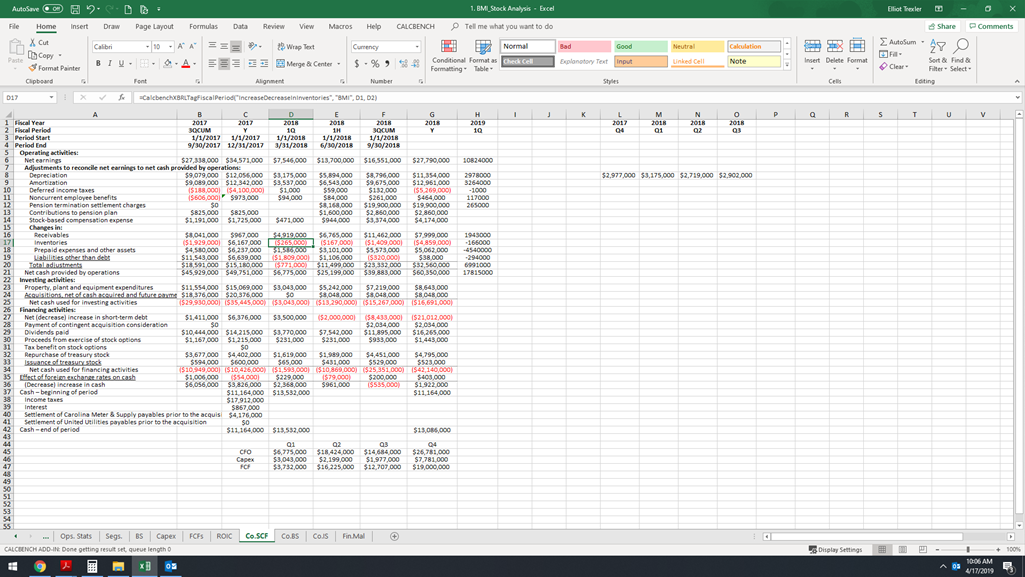

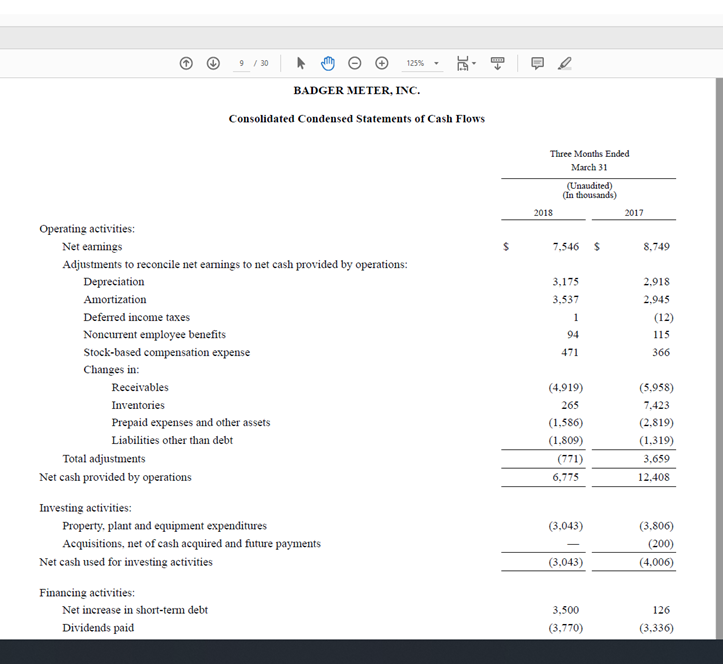

For example, if we retrieve Badger Meter's IncreaseDecreaseInInventories with =CalcbenchXBRLTagFiscalPeriod("IncreaseDecreaseInInventories", "BMI", 2018, "1Q"), we get -265,000. But on their statement of cash flows the number is reported as Changes in: Inventories +265.

The -265 in the XBRL indicates that there was a decrease in inventory of $265,000 (a credit of $265,000 to the inventory account). When creating the statement of cash flows using the indirect method, this decrease in inventory, is actually added back to net income (the amount was recognized as an expense in the calculation of net income but is not an outflow of cash this period since the inventory was already purchased, so should be added back to calculate the cash flow from operating activities), so is shown as a positive number in the company's filing.

0 Comments